Bank of America is one of the biggest banking institutions in the United States. It offers a wide range of banking products and services and financial solutions to a wide range of customers.

I have been a Bank of America customer for quite some time already. I am amazed at how the bank continuously improves its services for its customers. One of its great banking solutions is the mobile application.

Bank of America makes all of its financial and banking services available on its mobile application. Learn more about the Bank of America Mobile Banking app and its features below. Check how to install the Bank of America Mobile Banking app.

- Get to Know Bank of America

- Discover the Privacy Features of the App

- Create an Account on the Bank of America Mobile Banking App

- Receive Account Alerts from the App

- Transfer Money via the Bank of America Mobile Banking App

- Pay Bills Online via the App

Get to Know Bank of America

Undoubtedly, everyone living in the United States has at least heard about the Bank of America. The Bank of America is multinational financial services and investment bank. The banking institution has been offering its services for over 240 years already.

The bank is the second-largest banking institution in the United States serving more than 10% of the total American bank deposits. It started as a simple bank in San Francisco, California, but is now headquartered in Charlotte, North Carolina.

Bank of America provides financial services on investment banking, commercial banking, and wealth management. With the wide range of products, the bank welcomes customers making it the eighth-largest bank in the world.

Aside from financial solutions and banking products, Bank of America is committed to providing a quality banking experience to its customers. One of the offerings of Bank of America is the mobile banking application.

Installing the Bank of America Mobile Banking App

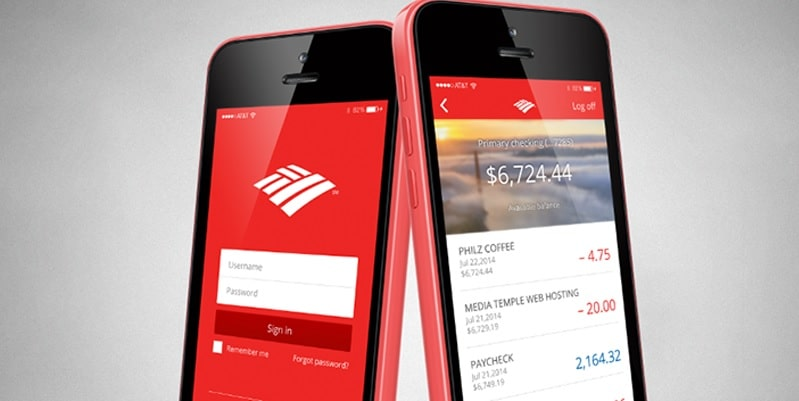

I have been a Bank of America customer before the Bank of America Mobile Banking app was launched. The Bank of America Mobile Banking app became available in 2011 with the intention to provide convenient banking transactions to all customers.

The Bank of America Mobile Banking app is available on the Google Play Store and the Apple App Store. The Bank of America Mobile Banking app is compatible with devices running on AndroidOS 6.0 and up and iOS 13.0 or later.

Discover the Privacy Features of the App

When the Bank of America Mobile Banking app was released, I did not immediately install the app because of my doubts regarding online security. I didn't want to compromise my online security for a possible threat of breach of personal information.

Bank of America promised that it has excellent technology to protect all the app users’ privacy. The Bank of America Mobile Banking app provided its End User License Agreement upon installation for us users to understand how we should use the app.

In addition, the Bank of America Mobile Banking app laid out its Privacy and Security policy that abides by the laws on US Consumer Privacy and California Consumer Privacy. The app listed all the personal information that it will collect from its users.

When I read the Privacy Policy of the Bank of America Mobile Banking app, I was convinced that it will protect my privacy at all costs. The bank gives users the power to share the information that we would only like to share and opt out of ads and receive promotional emails.

Reading More About the App’s Privacy and Security

Proving that the Bank of America values the users’ privacy, I learned that the bank conducts regular assessment reviews. These reviews are meant to ensure that the bank and its app are abiding by the privacy standards in protecting the collected, shared, and used personal information of the users.

Moreover, the app explained that it gathers personal information every time I use, visit, or interact with the bank online. The data collection also happens through the ads displayed on the Bank of America’s online services and other non-affiliated third parties.

The Bank of America clarified that the Bank of America Mobile Banking app will only use and share the collected share personal information to improve the products and services. The collected information can also be used for event management purposes.

Create an Account on the Bank of America Mobile Banking App

It took no time before I installed the Bank of America Mobile Banking app because I was convinced of the security and privacy features of the app. Upon installing the app, it immediately asked me to create an account to enjoy its content and features.

To create an account on the Bank of America Mobile Banking app, it wanted me to provide the last six digits of my Bank of America account. The app also accepts either my Social Security Number (SSN) or Tax ID Number (TIN).

The app only took a few moments to check if my provided information matched their records. If not, the Bank of America Mobile Banking app would ask me to retype the information accurately. Then, I provided my other personal information, like name, address, etc.

After providing the personal information, I can now create my user ID and password to log in easily next time. The Bank of America Mobile Banking app supports saving the user ID on the app, so I do not need to type again the user ID again the next time I want to use the app.

The Login Security Features of the App

To prove further that using the app is safe, Bank of America ensured that only the users can access our accounts on the Bank of America Mobile Banking app. The bank offered two ways that we can log in on our Bank of America Mobile Banking app.

First, I can use my duly registered login credentials. I only need to enter my user ID and password registered when I created the account. The second option is to use my phone’s fingerprint and face ID to log in to my account.

The Bank of America Mobile Banking app automatically detects suspicious attempts in logging into all users’ accounts. If there is a detected attempt, I will immediately be notified by the app so that I can check my account if there are unauthorized transactions.

Receive Account Alerts from the App

One of the security features of the Bank of America Mobile Banking app is the account alerts. This notifies users of suspicious account login attempts. There are more alerts that I could receive from the app to ensure that I can minimize threats to my account.

The Bank of America Mobile Banking app sends texts and emails to confirm transactions using my account. Thus, it will be easier for me to detect any unusual card transactions such as drastic spending, questionable usage in a different location, or any other unauthorized transactions.

Upon learning that there are questionable activities on my Bank of America account, I can immediately report it to the bank. In addition, the app notifies me whenever there are attempts to change my personal information on my Bank of America Mobile Banking app.

The Bank of America Mobile Banking app specifically sends alerts when I change my phone number, address, user ID, and password.

Enjoying the Account Management Features of the App

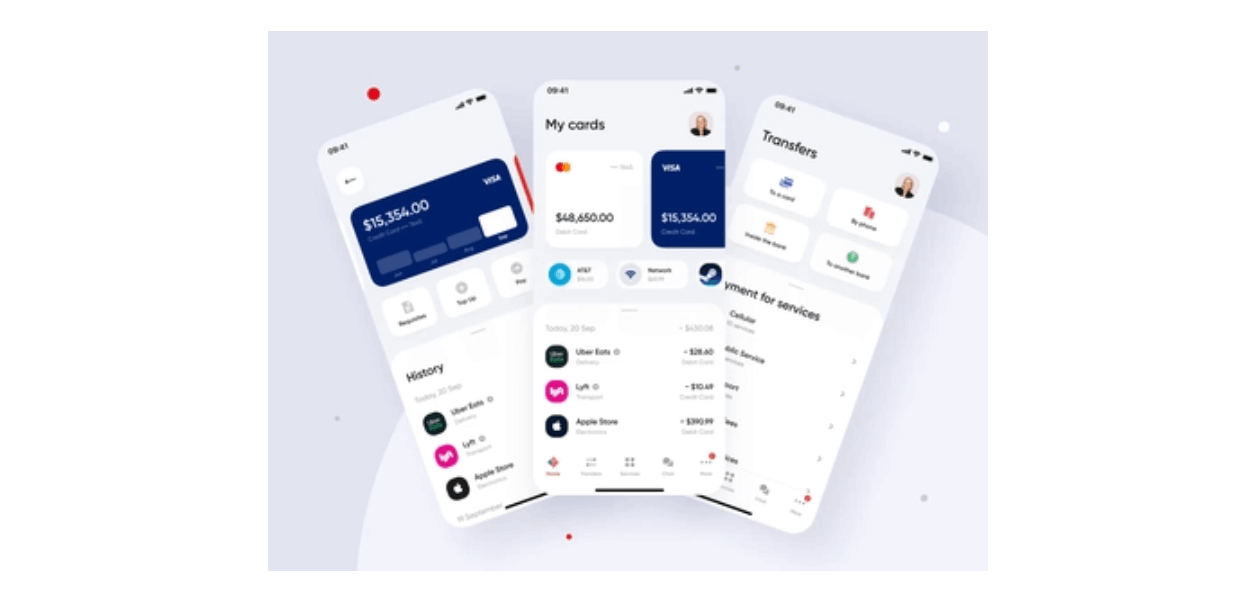

One of the primary features of the Bank of America Mobile Banking app is account management. As mentioned, the Bank of America wanted to make the customers manage our accounts anytime and anywhere.

I liked that it is possible to review all my activities and transactions on all of my Bank of America accounts, may it be checking, savings, or credit. Moreover, the Bank of America Mobile Banking app allows me to view my auto loans, mortgage, and other account balances.

The Bank of America Mobile Banking app also supports setting up alerts for important account information like payment dues. Lastly, the app lets me request debit and credit cards so that I do not need to visit any Bank of America branch.

Transfer Money via the Bank of America Mobile Banking App

One of my most used Bank of America Mobile Banking app features is the money transfer. It lets me send and receive money online via the app.

This proves that the Bank of America Mobile Banking app provides convenience to its customers.

I do not need to go to a Bank of America branch to send and transfer money. The app asks me to enter the recipients’ US mobile number and email address with Zelle.

The money transfer is also applicable between my Bank of America accounts. This money transfer feature is best whenever I need to pay or have transactions in an account but am short of funds.

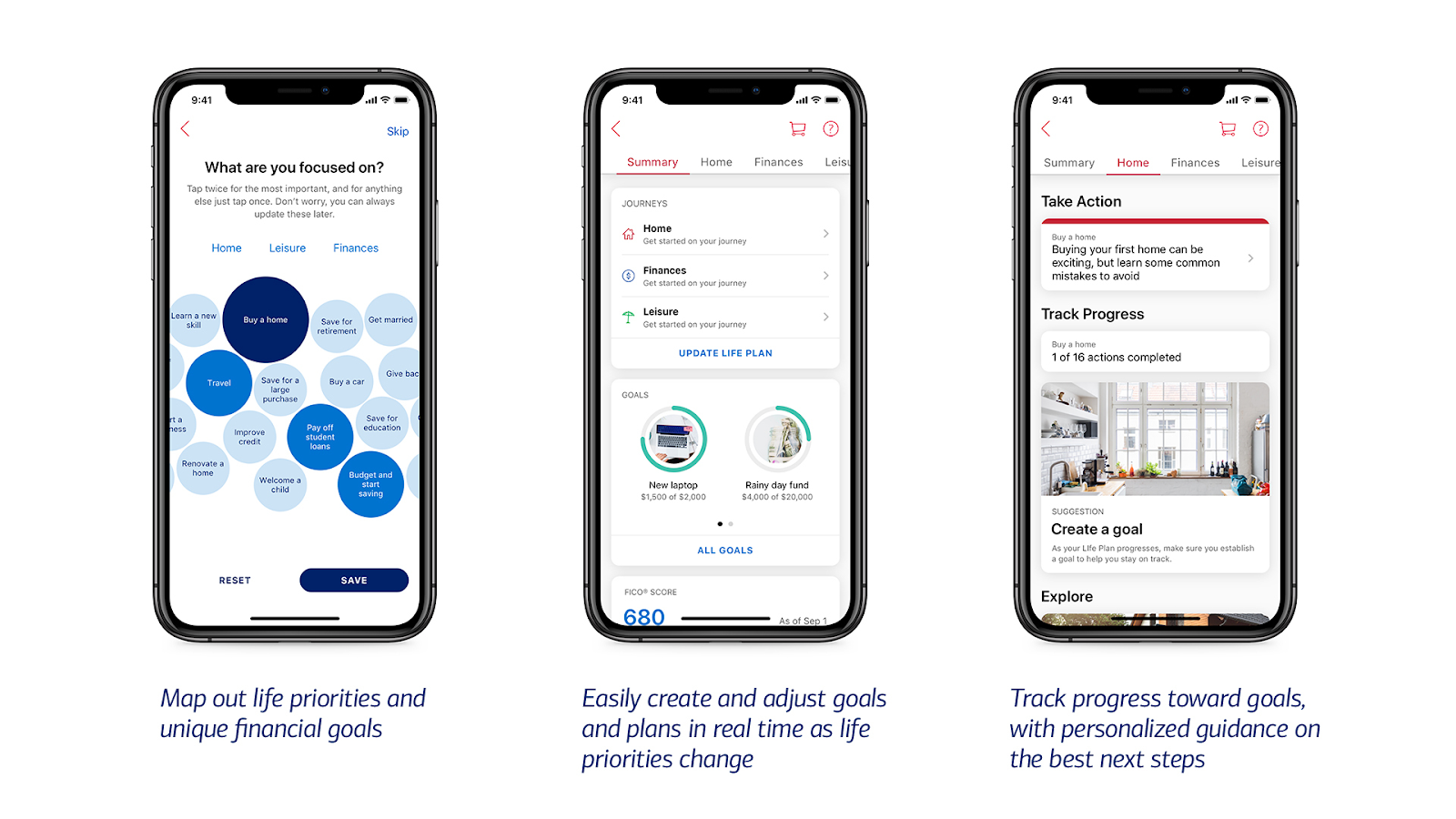

Checking My Credit Score on the App

The Bank of America Mobile Banking app lets me access my credit score, so I could check the transactions that greatly affected my rating. The app lets me have free access to my FICO credit score.

My credit score is displayed on my app’s profile. The Bank of America Mobile Banking app also provides the key factors that impacted my credit score and some tips to improve it further.

Pay Bills Online via the App

Another feature that proves the convenience that the Bank of America Mobile Banking app brings is the bill payment. I can easily set a scheduled payment for recurring dues and bills.

I also use the Bank of America Mobile Banking app to pay for my online shopping and utility bills as it supports eBills. I only need to scan QR codes or manually type the recipients’ or bill information.

Then, I need to choose the Bank of America account where the payment will be credited.

Being Guided by Erica

Interestingly, Bank of America introduces Erica to all its mobile banking users. Erica is the users’ virtual financial assistant on the app.

I often ask Erica for several financial solutions and tips as it offers valuable insights and financial guidance. Erica is also capable of paying bills, transferring money, monitoring credit scores, and more.

Conclusion

The Bank of America Mobile Banking app proves that it is a convenient and safe platform for its customers to experience mobile banking 24/7 at their fingertips.