I have been a loyal customer of Capital One bank for a long time. I trust the bank because it offers great auto loans, credit cards, and savings account services. Capital One is also one of the few reputable technology-focused banks.

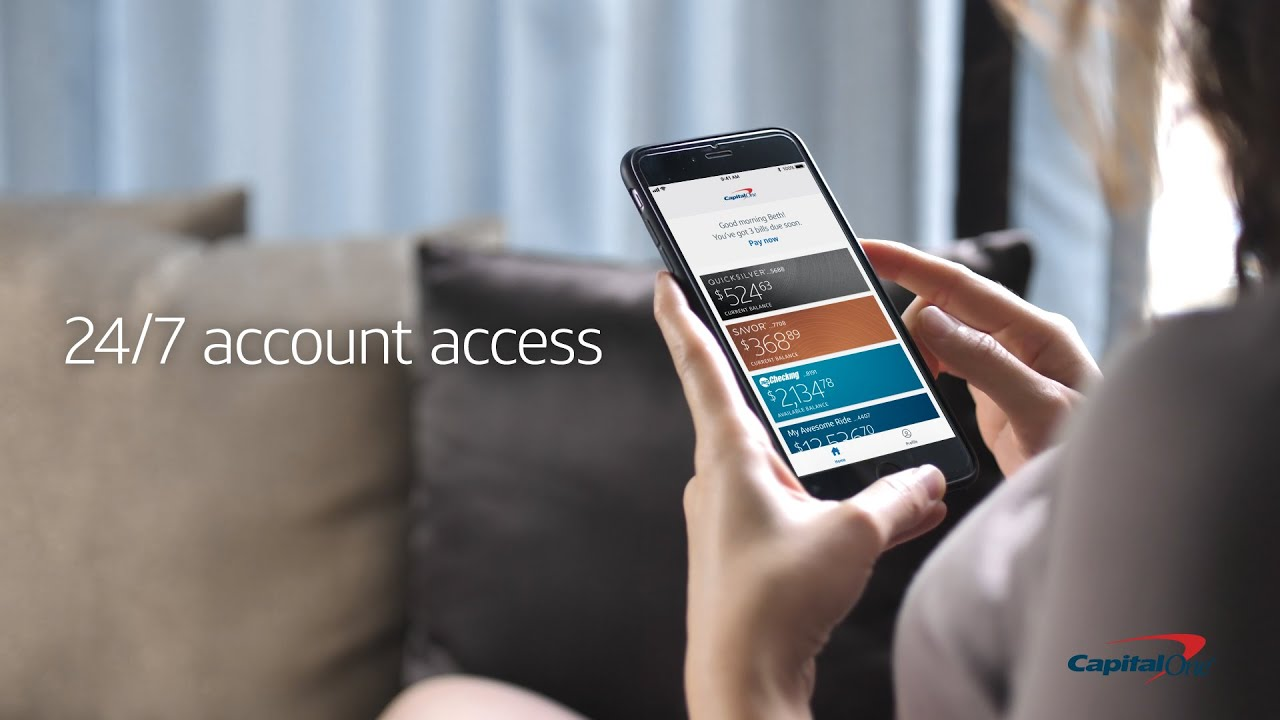

Being a technology-focused bank, Capital One offers an innovative banking experience for its users. Its main innovation is Capital One mobile banking through an application.

Learn more about the Capital One app and its features in this article. Discover how I save time by doing my banking through the Capital One Mobile app. Check how to install the Capital One Mobile app on your mobile devices and more.

Introducing the Capital One Mobile App

Capital One is an established financial and banking institution in the United States. The bank has over 60 million customers in the United States, the United Kingdom, and Canada. To cater to its customers, Capital One has over 750 branches and 2,000 ATMs.

As its most popular service, Capital One is the fifth-largest credit card issuer by purchase volume in America. In addition, the bank is the second-largest auto finance company in the US. It operates with three divisions: credit card, consumer banking, and commercial banking.

The banking institution has continuously grown since its establishment in 1994. Through the years, it has established itself as one of the most reputable technology-based banks. Capital One seamlessly integrates technology into its services to provide an excellent banking experience to its customers.

As proof of its adherence to technological advancement and innovation, Capital One launched its mobile banking app in 2016. The Capital One Mobile app aims to cater to all the customers' banking needs anytime and anywhere.

Downloading the Capital One Mobile App

When I started being a Capital One customer, the mobile banking app had not been released yet. I was excited as the bank promised that the Capital One Mobile app would provide the convenience I needed for my banking needs.

The Capital One Mobile app lets me track my finances by monitoring where all the transactions made on my Capital One account. The mobile banking app allows me to manage my accounts, access statements, pay bills online, redeem rewards, and much more.

The Capital One Mobile app is available on the Google Play Store and the Apple App Store. Capital Bank also lets everyone download the app through SMS by sending “GET” to 80101 to Capital One to instantly install the Capital One Mobile app.

Also read: Discover The Most Downloaded Finance App In Recent Times

Creating an Account for Online Access on Capital One Mobile

When I installed the app, I did not instantly get to enjoy its features. Capital One Mobile asked me to create an account to duly set up my online access to my Capital One account. I only need to proceed to the “Set Up Online Access” option.

The app required me to indicate my personal information, like my name and birthday. For further verification, the Capital One Mobile app asked me to provide my Social Security Number or Individual Taxpayer Identification.

I was also required to input my Capital One account numbers. Then, it asked me for my email address, phone number, and other personal information. Capital One Mobile needs to verify my identification by matching its records.

After successfully verifying my account, I created my unique username and password for Capital One Mobile. From then on, I only need to sign in using my duly registered username and password on the app.

Securing My Log-In on Capital One Mobile

I like Capital One bank's dedication to protecting mobile app users’ privacy and accounts. The bank designed several security features to ensure no one can access the users’ accounts except them.

In the recent updates of the Capital One Mobile app, it launched two-factor authentication verification via SMS. In addition, it is now possible to use facial and fingerprint recognition biometrics to log in to my account.

However, the facial and fingerprint biometrics feature is only available on mobile devices that support this security feature.

Getting a Virtual Credit Card Number on Capital One Mobile

Capital One Mobile offers a virtual credit card number feature to its customers. With this exciting feature, I do not need to have my actual card with me every time I make a purchase using my Capital One credit card account.

This is great for me as I cannot remember my credit card details. Even if I do not have my credit card with me as I check out a product online, I do not need to worry as I already have my virtual credit card number.

Capital One allows mobile bank users to request a virtual credit card number. It is important to note that it is entirely optional, which means I can get it any time I want. I also feel safe purchasing things online with this feature.

There is an additional two-step verification to complete a request for a virtual credit card number. Users are also allowed to cancel the virtual credit card number anytime.

Checking the Other Capital One Mobile Security Features

Aside from strict log-in features, there are other security features offered by the Capital One Mobile app. It is easy to lock my credit cards on the app whenever I lose them. Once locked, the bank will automatically refuse any transactions made using my credit card account.

The declined transactions include recurring payments, returns, and rewards redemption. I do not need to worry that there might be other people who can use my credit card without my permission if I have not found my credit card yet.

If I just misplaced the card and find it immediately, I can also instantly unlock it on the Capital One Mobile app. There is no need to call for help from the bank’s customer support. It is also easy to request card replacement as Capital One offers the new credit card for free.

Also read: How To Use Splitwise To Split The Bill And Track Expenses

Utilizing Capital One Mobile to Manage Capital One Accounts

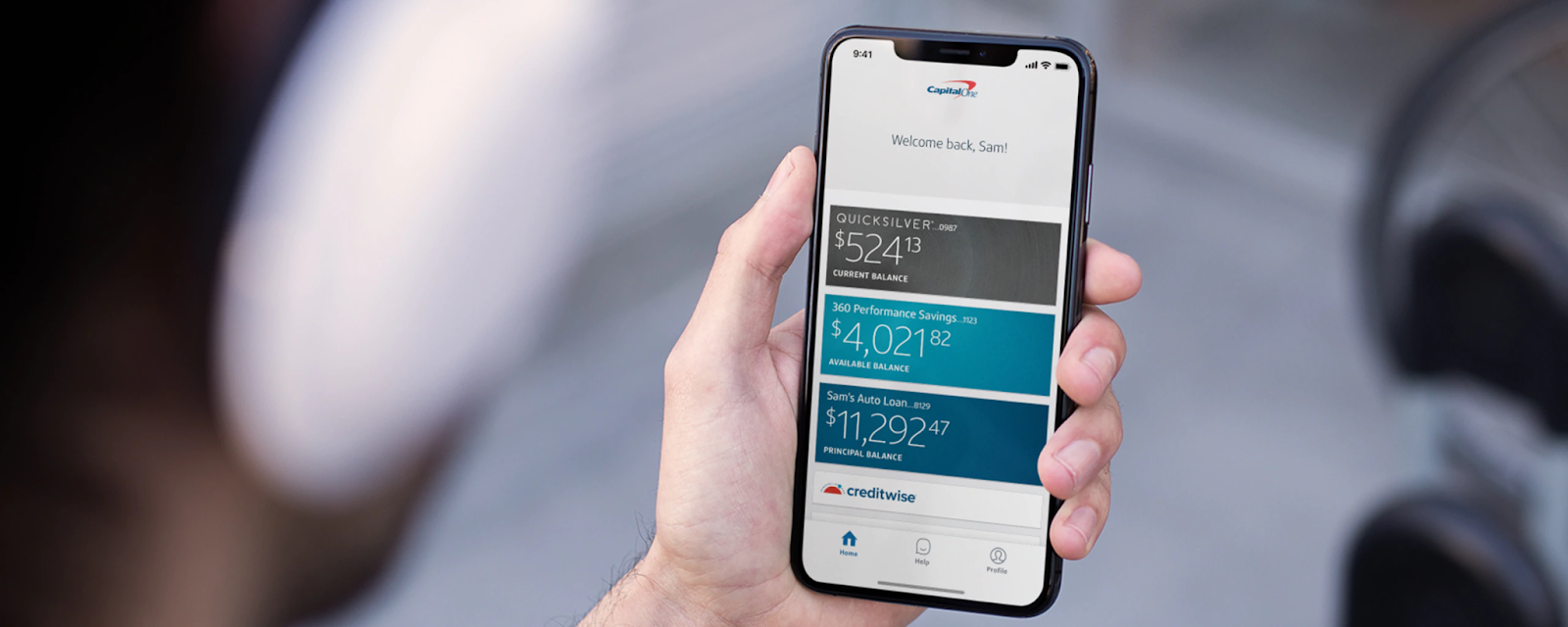

True to its mission to provide convenience, Capital One lets me manage all my accounts in one place—Capital One Mobile. As its primary feature, it is easy to access all my Capital One accounts on the app to get all the card information at my fingertips.

Capital One Mobile supports managing multiple accounts at once. I only need to check and switch the accounts with just a few taps on the app’s home page. I can also choose which Capital One account I want to use for a specific transaction.

The app records all transactions on each account to ensure that all my purchases and payments are made correctly.

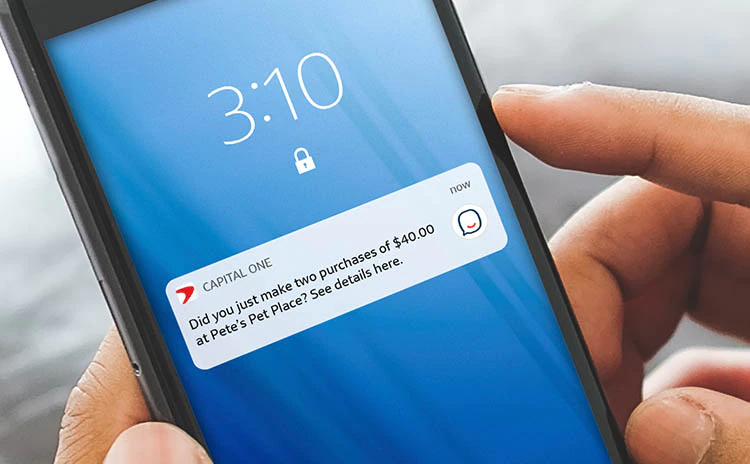

Getting Notified via Account Alerts

To avoid any possible confusion on the reports on my account transactions, Capital One Mobile provides Account Alerts. I liked that I get a notification every time there is a transaction made using any of my Capital One accounts.

There are two ways that the app sends notifications—either by email or push notifications. Capital One Mobile lets me customize the alerts I receive by specifying the transactions I want to be notified about.

Through this Account Alerts feature, the bank lessens the potential threat of fraud on my Capital One accounts.

Collecting Rewards via Capital One Mobile

One of the most used features of the Capital One Mobile app is its rewards balance. It is possible for me to check my current rewards balance through the app. At the same time, Capital One Mobile allows me to redeem or collect rewards.

Before collecting any reward, the app wants me to check all the available rewards. After checking them all out, Capital One suggests that I should pick the best deal among them based on my needs and desires.

The rewards system can be in the form of discounts among participating retailers or as cashback.

Staying on Top of My Credit Score

Credit card benefits heavily rely on my credit score. Thus, Capital One wants me to stay on top of my credit rating or score. There is a built-in CreditWise tool that allows me to get my real-time credit score.

CreditWise offers advice and tips on how I can improve my credit score by listing all the recommended activities. The recommendations are based on my credit account activities, so it is indeed tailor-fit to my personal financial situation.

In addition, there is a detailed explanation and instructions on how I can improve my credit rating through purchases and payments. I get great insight into my credit history, payment history, utilization rate, and many more on the Capital One Mobile app.

Also read: Top 5 Best Investment Apps for Beginners: How to Invest Easily and Secure

Online Bill Payment on Capital One Mobile

One of the most helpful features of the Capital One Mobile app is bill payment. I can easily pay any bills through the app by setting up automatic payments. In this case, I will not miss out on any dues with my Capital One credit card.

This feature also helps me avoid penalty charges for paying online, as the app automatically sends my payment based on my set schedule. I can adjust the automatic bill payment anytime, depending on my need.

Sending Money via Capital One Mobile

As part of its mission to provide convenience to its customers, Capital One Mobile supports sending money to anyone for free. I only have to provide the other users' US mobile numbers or email addresses.

It is important to note that money transfer on the app is only available among Capital One Mobile users. Once I send the money successfully, I will get a copy of my receipt. The bank will also notify the recipient that they received the from me alongside the amount sent.

Conclusion

To prove that it is indeed a technology-focused bank, Capital One launched its mobile banking app to improve the banking experience of its customers. The Capital One Mobile app is best for account management, rewards redemption, and bill payment.