When two people decide to merge their lives, whether that is moving in together or getting married, one of the biggest points of contention is financials.

The good thing about nowadays is that there are many apps available that can help you with money management. One of these is the Honeydue app. So let's take a look and see if this is the right money management app for you.

- Honeydue App – What Is it?

- How to Download the App

- How to Sign Up

- Key Features of the App

- Are There Any Costs?

- Pros of Honeydue

- Cons of Honeydue

- How about My Money's Safety?

- Best Ways to Use the App

- Financial Tips for Couples

Honeydue App – What Is it?

I don't know about you, but when it comes to finances, it's a hard conversation to have with anyone, let alone your significant other.

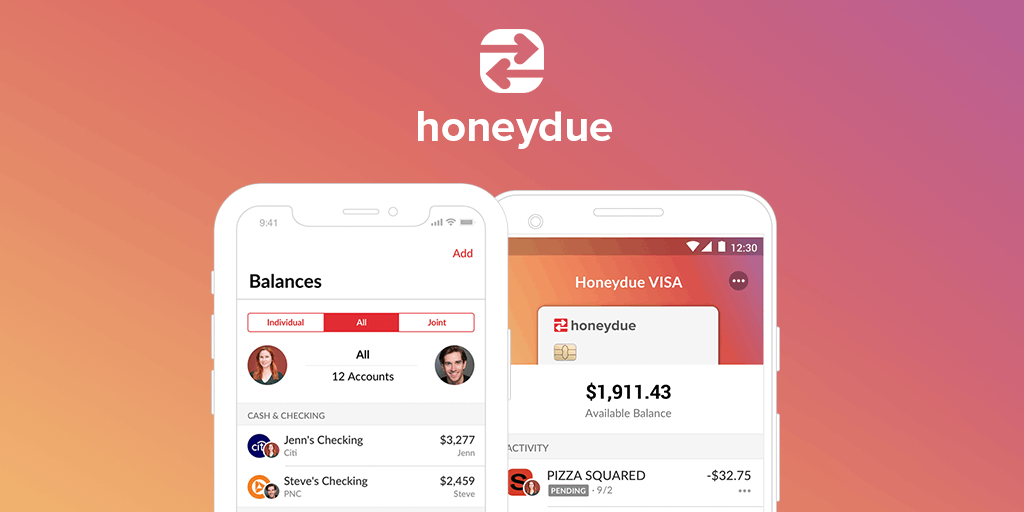

Honeydue is an app that can help make this conversation a little less stressful. The app is helpful because it gives couples access to their budget at the moment.

This app is excellent as it helps couples stay on the same page. It is easy to use and comes with many features that will make setting up budgets and doing financials so much easier.

In addition, the company that runs this app has a mission statement to ensure we all can decrease the odds of arguing over money.

Is it Available on Desktop?

Unfortunately, the app is only available to download on mobile devices.

Unlike other money management apps, there is no desktop version available.

For me, this is one of the things that I dislike the most about it, and we will discuss that further in a section below.

How to Download the App

If you and your significant other need an app for money management and want to download this app, you will first need to go to the store corresponding to your mobile device's operating system.

Then you will search for the Honeydew app and navigate to the apps page.

Once you have navigated to the page, all that is left is for you to click on the install button and wait for the download to finish.

After the download has finished, you then need to open up the app and begin the signup process.

Where Can You Download the App?

The app is available on both Android and iOS, so you will find it on both the Google Play Store as well as the Apple App Store.

So if you are looking to download it to help with your and your significant other's financials, you will be able to download it from the relevant store.

How to Sign Up

When the app first opened up, I was prompted to set up my account using an email.

Once I had set up my name and email, my profile was ready, but before I could actually get started, I had to wait for an email to verify that this account is active.

Once I had done that, it then prompted me to invite my partner. It did this by asking for my partner's information, specifically their email.

Once you have given the app this information, it will then create an email and send an invitation to that account. All that is left is for your partner to accept the invitation.

Lastly, You Need to Sync Your Accounts

The syncing of your bank accounts is not a necessary step. In fact, if you do not want to do this step, you can choose to go manually.

For my partner and me, we opted to sync so as it would be much easier to watch the activity log.

Key Features of the App

One of the things I like about this app is that there are many great features that are easy to use.

For example, once synced to your account, the app will allow you visibility of an activity log so that you are aware of your balances on these accounts at all times.

You are also able to categorize account transactions so that you can monitor specific financial expenditures as a category.

This feature really helped me create a solid household budget so that my significant other and I could ensure we were both doing our parts. There are also a couple of other handy features.

In-app Communication

You can also track bills and due dates on a calendar so that it increases your ability to manage your household finances.

When one comes up, you don't even need to leave the app as you can text your partner about the said bill or even a transaction through Honeydue DMS.

Are There Any Costs?

When you're speaking of finances, one of the biggest concerns is extra expenditures, and so it is totally understandable that one of the biggest questions about this app would be the cost.

Many of these financial management apps will have multiple fees, both in-app as well as a subscription.

The Honeydew app, though, is free to download as well as to use. This is nice as there will be no extra fees attached to any budget created by you and your significant other.

I was very shocked by this as I wondered how they made their money. This question is something I still don't understand, but that's OK.

A Great Tip

You will see where you can elect to pay the company a tip for utilizing their service.

If you choose to go this route, you can choose the amount, ranging from $1 to $10.

This will be withdrawn monthly unless you turn off the auto-renewal option on your subscription tab.

Pros of Honeydue

So what are some of the benefits you get from choosing this money management app? For me, the first thing was that you get to download it free and use it for free.

Though, as we said above, you can opt to give a tip to the company that is not a requirement.

On top of that, because you can sync your accounts with your partner, you can share your budgets and transactions so that everything is transparent when it comes to your joint finances.

In addition, you can keep accounts for both of each other as well as a joint account synced to your Honeydue profile.

What about My Bills?

You can also set up bill reminders so that there is never a time that you forget about and expenditure.

Making sure that you are always able to keep up to date on all your bills will not only help with your budget but your credit as well.

Cons of Honeydue

Of course, there are a few things that may be an issue for some. The biggest may be the fact that the app is only available on mobile devices.

Other apps like Mint have a desktop version so that you have access to your finances at all times from any device.

The app, though comprehensive, does have a limited ability in comparison to other money management apps.

So the limited capability to analyze your spending does detract a little from the overall benefit of this app, which some may find a reason to opt to go with another money management app.

Anything Else?

Other than that, the only other issue that I could see was that there is no rollover budget option.

This feature could be helpful when couples have maintained a tight budget and have some cash left over from the previous month.

Having the ability to roll over extra funds when it comes to budgeting could be very handy.

How about My Money's Safety?

When it comes to giving access to your bank account, one of the biggest concerns we as a couple always have had is the safety of the connection.

So when it comes to Honeydew, is your money and personal information safe? When it comes to security, the company is very transparent.

If you head over to their website, you will find a page that talks solely about their security. There you can get an in-depth look at the measures they take.

For example, the company uses a 256-bit encryption for both transit and storage, and they also use multifactor authentication to protect access to your account.

So Is it Safe?

So, is this app safe? Yes, it seems that Honeydew has taken every precaution possible to guard your personal information as well as your accounts.

On that same page of their website, the company goes over some key things you can do to protect your information further.

Best Ways to Use the App

There are multiple ways that you can use this app to your benefit. The first way you can use this app is to monitor your finances.

This app can be used for both your finances as well as the finances of you and your partner. The features work just as well for an individual as a couple.

For couples with children, it is also a great way to help teach them about being responsible for their finances.

In this case, instead of creating a joint account with your partner, you would create it with your child, and this could be a great learning lesson for them.

Are Joint Accounts Good?

Of course, the biggest benefit is the fact that you can create joint accounts with your partner.

When this is done each of you get prepaid cards issued by FDIC approved bank that have limits.

These cards can be used to pay bills and do other financial transactions that you have both agreed on as shared.

Financial Tips for Couples

Even with a financial app like Honeydue, there are still some financial tips that could be very helpful for couples.

I find that if you treat your finances as a business matter and set up a day and time to go over the budget, it is much easier to maintain.

Another big tip that can help couples and has helped me is to make sure you guys sit down to brainstorm long-term and short-term goals and dreams.

This will give you a goal to meet and a structure to set up your budget for.

Dividing the Financial Responsibilities

But the biggest thing that helped me, and hopefully me sharing this with you will help you.

After looking at your bills, you can decide to either keep separate accounts and divvy up the financial responsibilities.

Or you can use this app to set up a joint account so that each of you pays your fair share.

Summary

One of the best ways to manage money as a couple is to be honest and set a realistic budget. The Honeydue app can help you monitor as a couple your ability to maintain that budget.

Hopefully, this look at this money management app has helped you figure out how you want to tackle your finances as a couple.