Banking worldwide has moved from face-to-face service to a hybrid of offline and online banking. In addition to the online banking and office service, National Westminster Bank developed and published a mobile banking application.

The NatWest Mobile Banking app puts you in control of your money, wherever and whenever you need it. So whether you're on the train or enjoying a day out, the mobile banking service gives you the utmost flexibility to stay on top of your finances using your smartphone or tablet.

Your NatWest app is packed with features so you can manage your personal finances on the go. This article will give you a quick overview of the app's many features, how to use them, and some issues you might encounter.

About the NatWest Mobile Banking App

The NatWest mobile banking app is essentially a full bank operating from your mobile phone with you in control. The app is your bank on the go, so you can monitor your accounts, make payments, and check your balance 24/7.

Simply register your United Kingdom or international phone number with mobile banking, and you'll get instant access — whether you want to check details of your recent transactions or pay bills directly from your phone.

The NatWest app is a faster, simpler, and more convenient way to bank. Plus, it comes with 24/7 customer support — so there's always someone ready to help.

In the years preceding this app's launch, NatWest offered customers online banking options. However, executing transactions via online banking on their website has its limitations.

Requirements to Download the App

The NatWest app is only available in the Apple App Store and the Google Play Store for Apple and Android devices, respectively.

An iPhone must be using the iOS 13.0 operating system to effectively run this app, while the minimum Android requirement varies by device. To ensure a smooth download and installation, ensure that your device has at least 200 megabytes of unused storage.

Once you download the app, enter your online banking login details. First, confirm your phone number by entering a code sent to your mobile device, then select your mobile banking passcode. Finally, choose how you want to log in (by selecting a preference from a list) and customize the main screen to your liking.

Also read: How To Use Splitwise To Split The Bill And Track Expenses

Features of the NatWest Mobile App

The NatWest app features a new interface and design that helps you manage your banking from anywhere, at any time. In addition, the app promises greater control of your finances by enabling account holders to make quick and easy transactions.

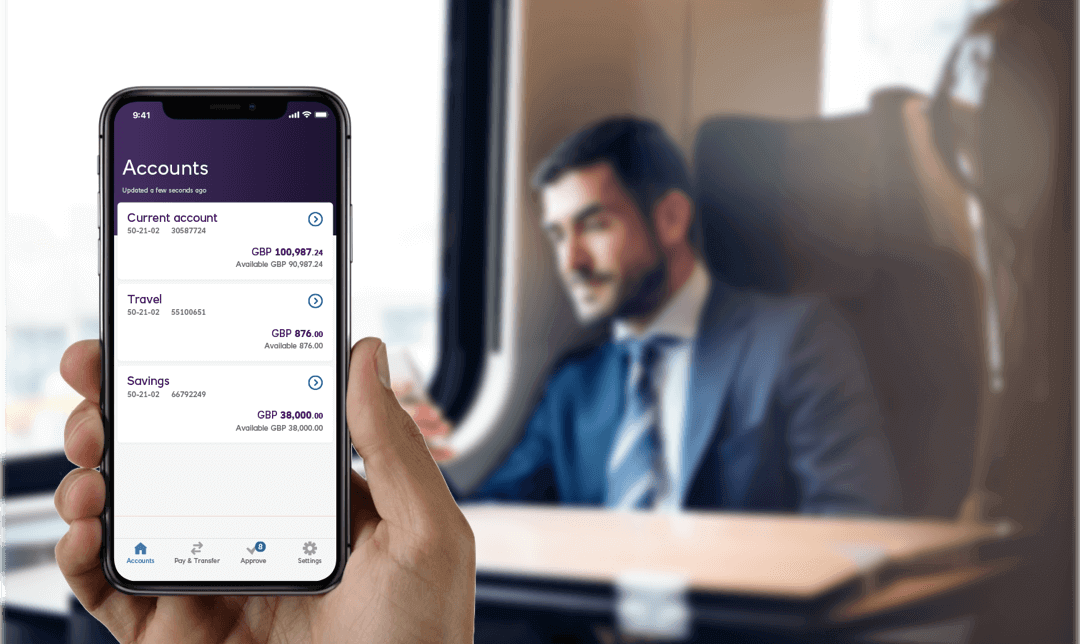

The app covers common features of mobile banking found on most banking apps, such as sending money without a card reader and quickly checking your account balance and transaction history. You could also move money between personal accounts, deposit cheques, and withdraw cash from an ATM without a card.

Moreover, the app lets you check the status of direct debits and standing orders and enables you to monitor and handle bill payments easily. Users can also open a new savings account, apply for a checking account, and manage all connected accounts from one place.

There's even a customer care messaging tool that lets users ask for help any time of day. So if you encounter any problems or require assistance at night, your solution is always a text away. All you need to do is simply open the app and send a message to customer support.

Security, Anit-Fraud Checks, and Management

The NatWest app uses a combination of security and anti-fraud checks to help ensure a secure banking experience. The app secures your data and monies by implementing security and anti-fraud measures. These measures include confirming the device being used is yours and checking to see if your device has been recently updated or compromised.

The app is personalised and fully protected with multi-layered security. As the first line of security, you can set up your app to require personal details such as your relationship with your bank and their respective account numbers before logging in. As an additional layer of security, it includes biometric and face ID authorizations.

Apart from providing the same simple and safe banking experience, the NatWest app also comes with some extra handy features. For example, if you lose your card or it is stolen, instead of calling to report it, you can open the app and lock your card immediately with just one tap — before any unauthorized transactions occur.

Also read: Check Out the Best Banking Apps

Setting up Fingerprint Login and Face ID

With the NatWest Mobile Banking app, you can log in to your account with a fingerprint or face ID, which is an added layer of personalized security.

To set up the fingerprint or Touch ID feature, ensure you've already enabled them on your device settings. Then, go back to the app and locate your profile setting. Once there, find and allow the Touch ID or Android Fingerprint feature.

The Face login is limited to iPhone X or later models. For the Face login, go to the profile settings and enable face ID. Next, log out and log back in with your password, and then the app will prompt you to use your face.

Checking Your Balance and Making Payments

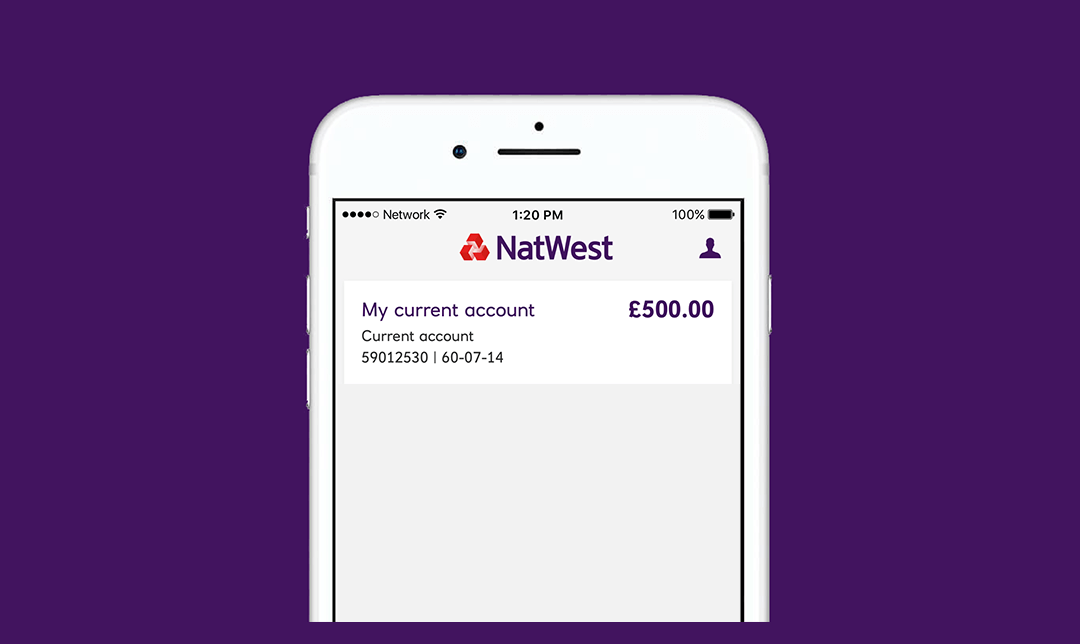

If you want to check your account balance, simply log in to the app, and on the home page, you'll find an overview of your account displaying the ledger balance and available balance.

To make a payment, you must have the recipient's first and last name or company name, account number, account type, and sort code. Then, from the main page, tap on the account from which you want to make the payment and select "Payment."

Input all relevant recipient information, the amount to send, and what date you want it to go through. After confirming the payee, simply authorize the transaction via biometric approval or by entering your login details, then cross-check the payment details and tap "Make Payment."

Easily Manage Your Bills with the NatWest App

Not everyone likes to sort bills and be neck-deep in paperwork, but this app makes managing your bills easier. Direct debits, standing orders, and paperless reports are three features dedicated to helping you pay your bills on time, the way you like, without hassle.

A standing order is an instruction your bank executes on your behalf to make recurring payments on a specific date. An example is paying rent or putting money into your savings account. You decide how much, when, and how often the payments should happen, along with the reference.

To set it up, select the account to debit from, tap on standing order, choose your recipient and follow on-screen directions to specify reference, amount, and intervals. Then review and confirm the information. You can also amend or cancel the order from the app.

The paperless option is only available for credit card statements, so you'll need to use online banking to change the choice for all accounts. On the app, locate your MasterCard, select my statement, and then the "get the statement" option. On the next page, change your delivery preference to "By Email."

How to Set Up a Direct Debit for Credit Card Payments

If you have a credit card with National Westminster bank, you can set up a direct debit for repayments on the app. Log in, select the credit card you want to arrange the payment for, and tap "pay my card."

On the next screen, a direct debit form will appear. Follow the instructions on the screen to set it up and view the order once everything is reviewed and completed. To cancel a direct debit, select the debit order and locate the cancel option at the bottom of the screen and select it.

Also read: Discover The Most Downloaded Finance App In Recent Times

Will You Encounter Any Problems While Using the App?

Well, that depends on when you're using it. By the time you install the app, the bank could have rectified some problems the app has.

Sometimes the app has a bug problem. From malfunctioning face ID authentication to transfers not reflecting early, time and again, technology can fail, and some features won't work at their best.

When you encounter bug-related issues, reload or reinstall the app and try again. However, if the problem continues, the best thing to do in such situations is to contact support for help.

More Features Than You Can Keep up With

The NatWest app has numerous features that give you a robust experience. For example, users can perform simple to complex banking transactions without stepping outside. In addition, whatever problems you have can be settled from home through a chat or phone call.

In addition to the basic banking features, the app also enables you to budget better and consume less money by categorizing your transactions according to their purpose.

Conclusion

The NatWest mobile banking application helps customers conduct their banking easily and conveniently with National Westminster Bank. The array of helpful and customer-friendly features attest to NatWest's dedication to seeing customers maintain control of their finances without hassle.

While online and offline banking can both be helpful at times, the mobile app has proven to be a more convenient and practical option for users. With the myriad of features for managing money and more incoming, you won't have to visit a bank for awhile!